Are dental implants covered by insurance?” This question is a common concern for many individuals considering dental implants as a treatment option for missing teeth. Dental implants are widely recognized for their durability, natural appearance, and functional benefits, making them a preferred choice for long-term tooth replacement. However, the cost of dental implants can be substantial, prompting individuals to inquire about insurance coverage.

In this section, we will explore the complexities of insurance coverage for dental implants. We’ll discuss the factors that influence whether dental implants are covered under typical dental insurance plans, including considerations for periodontal disease, surgical procedures, and tooth extraction. We will also address common limitations and exclusions you may encounter, and strategies for navigating insurance policies to maximize coverage benefits.

Understanding how dental insurance addresses dental implants is crucial for making informed decisions about your oral health and financial planning. Let’s delve into the details to uncover what you need to know about insurance coverage for dental implants.

What Are Dental Implants?

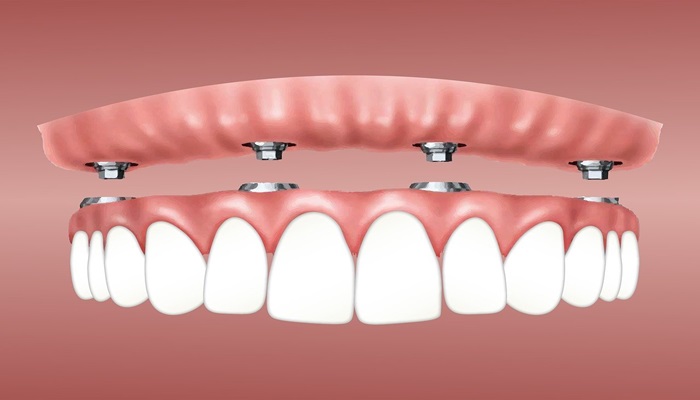

“Are dental implants covered by insurance?” Before delving into insurance coverage, it’s essential to understand what dental implants are and why they are a popular choice for tooth replacement. Dental implants are sophisticated dental appliances designed to replace missing teeth permanently. They consist of three main components:

- Implant: A titanium post surgically placed into the jawbone, serving as a sturdy foundation for the replacement tooth.

- Abutment: A connector piece that attaches to the implant and supports the prosthetic tooth or crown.

- Crown: A customized artificial tooth that is securely attached to the abutment, resembling a natural tooth in appearance and function.

Dental implants offer numerous advantages over traditional tooth replacement options like dentures or bridges. They are durable, stable, and designed to blend seamlessly with natural teeth, providing enhanced chewing ability and preserving jawbone structure. Moreover, implants promote oral health by preventing bone loss and maintaining the integrity of surrounding teeth.

Additionally, dental implants can be beneficial for individuals with certain medical conditions that affect oral health. For example, implants can be an effective solution for those who have experienced bone loss due to periodontal disease, and they may require bone grafting to ensure sufficient jawbone structure for implant placement. Maintaining excellent oral hygiene is also crucial to the success of dental implants.

While dental implants offer significant long-term benefits, their initial cost can be substantial. This leads many individuals to inquire about insurance coverage to alleviate financial concerns. Understanding the components and benefits of dental implants lays the groundwork for exploring how insurance policies address this advanced dental treatment.

Insurance Coverage Basics

When considering the question “are dental implants covered by insurance?”, it’s essential to understand the basics of how dental insurance typically addresses this advanced dental treatment. Dental insurance plans vary widely in their coverage of dental implants, which are considered a major procedure due to their complexity and cost. Coverage for implants often depends on the specific terms and conditions of your insurance policy.

Most dental insurance plans categorize procedures into preventive, basic, and major treatments, with implants falling under the latter category. The implant post, abutment, and crown are typically considered part of this major treatment. Indemnity plans, also known as fee-for-service plans, offer flexibility in choosing dentists but may require higher out-of-pocket costs. On the other hand, managed care plans like Preferred Provider Organizations (PPOs) or Health Maintenance Organizations (HMOs) often have lower costs but limit patients to a network of dentists.

Policy specifics such as waiting periods, pre-authorization requirements, and annual maximums can significantly impact coverage for dental implants. It’s common for insurance policies to have exclusions or limitations regarding implant coverage, such as only covering implants for medical necessity rather than cosmetic purposes.

Factors Affecting Coverage

When exploring the question “are dental implants covered by insurance?” several factors determine whether dental implants are covered under dental insurance plans. One primary factor is the type of dental insurance plan an individual has. Insurance plans vary widely in their coverage of major dental procedures like implants. Typically, indemnity plans may offer more flexibility but come with higher out-of-pocket costs, while managed care plans like PPOs or HMOs often have lower costs but limit patients to a network of dentists.

Another critical factor is the specific terms and conditions outlined in the insurance policy. Many dental insurance policies have exclusions or limitations concerning coverage for dental implants. Some policies may not cover implants at all, or they may cover only a portion of the total cost. Additionally, there may be waiting periods before coverage for major procedures like implants becomes effective, and pre-authorization may be required.

The overall cost-effectiveness of dental implants also influences coverage decisions. Insurance companies consider the cost-benefit ratio of covering implants compared to alternative treatments like bridges or dentures. Factors such as the patient’s oral health condition, the necessity of artificial tooth roots for restoring dental function, and the expected longevity of implants may also impact coverage decisions. Additionally, the patient’s history of tooth decay and the overall necessity of dental services provided by the implants can influence insurance coverage.

Understanding these factors is crucial for individuals considering dental implants and navigating insurance coverage options. Consulting with a dental provider and thoroughly reviewing dental plans can help clarify coverage specifics and determine the most cost-effective approach to receiving dental implant treatment.

Types of Dental Insurance Plans

When considering the coverage of dental implants under insurance, it’s essential to understand the different types of dental insurance plans available and how they impact coverage options. Dental insurance plans generally fall into two main categories, each with its own implications for covering major procedures like dental implants:

- Indemnity Plans (Fee-for-Service Plans): These plans offer the most flexibility in terms of choosing dental providers. Under an indemnity plan, patients can see any licensed dentist, and the insurance provider reimburses a percentage of the dentist’s fee. However, coverage for dental implants can vary significantly, with some plans providing partial coverage or excluding implants altogether. Patients may also be responsible for paying higher out-of-pocket costs under these plans.

- Managed Care Plans: Managed care plans include Preferred Provider Organizations (PPOs) and Health Maintenance Organizations (HMOs). PPO plans typically offer a network of dentists who agree to provide services at reduced rates for plan members. While PPOs may cover dental implants, coverage levels and out-of-pocket expenses can still vary. HMO plans, on the other hand, require patients to select a primary dentist from a network and may have stricter guidelines for coverage, potentially limiting options for receiving implant treatments.

In both types of plans, coverage for dental implants is often classified as a major procedure. Insurance companies evaluate the necessity and cost-effectiveness of implants compared to alternative treatments like bridges or dentures. Proper care, restorative care, and additional procedures, such as a bone graft, are factors that can influence coverage decisions. Other considerations include waiting periods, pre-authorization requirements, annual maximums, and deductibles.

Understanding the nuances of these dental insurance plan types is essential for individuals considering dental implants. Reviewing policy details, consulting with insurance providers, and discussing treatment options with dental professionals can help navigate coverage considerations effectively and determine the most suitable plan for receiving comprehensive dental care, including implant treatments.

Understanding Policy Limitations

When exploring whether dental implants are covered by insurance, it’s crucial to understand the specific limitations that insurance policies may impose. Insurance coverage for dental implants can vary significantly based on policy terms and conditions, which often include several key limitations:

- Exclusion of Cosmetic Implants: Many dental insurance policies do not cover dental implants solely for cosmetic purposes. Coverage is typically provided when implants are deemed necessary for restoring dental function, such as replacing missing teeth due to injury, decay, or bone density issues.

- Pre-existing Conditions: Insurance policies may have clauses regarding pre-existing conditions, which could affect coverage for dental implants. Some policies may exclude coverage for conditions that existed before the insurance policy’s effective date or impose waiting periods before covering certain procedures involving bone tissue and dental surgery.

- Annual Maximums: Dental insurance plans often have annual maximums, which limit the total amount of benefits paid out within a calendar year. If the cost of dental implants exceeds this maximum, the patient may be responsible for covering the remaining expenses out-of-pocket.

- Waiting Periods: Some insurance plans require a waiting period before coverage for major procedures like dental implants becomes effective. This waiting period can range from several months to a year or more, during which time the patient may need to continue paying premiums without receiving coverage for implants and related dental surgery.

- Alternative Treatment Options: Insurance companies may offer coverage for alternative treatments to dental implants, such as bridges or dentures, which are considered less costly alternatives. Coverage decisions often weigh the cost-effectiveness of different treatment options against the specific needs and oral health conditions of the patient, including the suitability of implant materials.

Navigating these policy limitations requires a thorough review of your dental insurance policy and discussions with your dental provider. Understanding the specific terms and conditions of your insurance coverage for dental implants, including bone density and implant materials considerations, can help you make informed decisions about treatment options and financial planning. Consulting with your insurance provider can clarify coverage details and provide insights into maximizing benefits for necessary dental care.

Tips for Maximizing Coverage

When exploring whether dental implants are covered by insurance, it’s important to consider strategies for maximizing your insurance coverage effectively. Here are several tips to help navigate coverage options and potentially reduce out-of-pocket expenses for dental implants:

- Review Your Policy Carefully: Understand the specific coverage details for major procedures like dental implants. Policies vary widely, so comprehending your benefits, including any exclusions, limitations, or waiting periods, is essential.

- Choose the Right Plan: Consider selecting a dental insurance plan that offers coverage for dental implants if you’re planning this treatment. Some plans may have higher premiums but provide more comprehensive coverage, including implants, with lower out-of-pocket costs.

- Discuss Treatment Options with Your Dentist: Your dentist or oral surgeon can provide insights into alternative treatments that are partially covered by insurance and achieve similar results to dental implants, especially for restoring oral function and addressing gum disease.

- Strategic Treatment Timing: Schedule dental implant procedures when you have reached or are nearing your annual maximum benefits limit to maximize the insurance coverage available for the treatment.

- Communicate with Your Insurance Provider and Dental Office: Clarify any questions about coverage, pre-authorization requirements, estimated costs, and financial planning options. Your dental office staff can assist in coordinating with your insurance provider to prepare for the out-of-pocket expenses associated with dental implants and other dental restoration procedures.

By following these tips and actively engaging with your dental insurance provider and dentist, you can navigate the complexities of insurance coverage for dental implants more effectively. Understanding your policy, exploring alternative options, and planning strategically can help ensure you receive comprehensive dental care while managing costs appropriately.

Conclusion

In conclusion, the question “are dental implants covered by insurance?” requires careful consideration of various factors related to dental insurance policies. While dental implants offer significant benefits in terms of functionality, aesthetics, oral health, and quality of life, their coverage under insurance plans can be complex and variable.

Throughout this discussion, we have explored the basics of dental insurance coverage for dental implants, including policy limitations, types of insurance plans, and tips for maximizing coverage. It’s clear that coverage for dental implants varies widely among insurance providers and plans. Some plans may offer partial coverage, while others may exclude implants altogether or have specific conditions for coverage eligibility.

For individuals considering dental implants, it’s essential to review their insurance policy details carefully and discuss coverage options with their dental provider. Understanding policy terms, such as waiting periods, pre-authorization requirements, and annual maximums, can help individuals navigate insurance considerations effectively. Additionally, assessing dental histories and the need for implant placement can provide further clarity on potential coverage.

Furthermore, exploring alternative treatment options and planning dental care strategically can help manage costs and optimize insurance benefits. Communication with insurance providers and dental professionals is key to clarifying coverage details, estimating out-of-pocket expenses, and developing a financial plan that aligns with treatment goals. Considering the stable foundation that implants provide, discussing these factors is crucial.

Ultimately, while dental implants may not be fully covered by insurance in all cases, proactive engagement with insurance policies and dental providers can facilitate informed decision-making and access to quality dental care. By leveraging available resources and understanding insurance coverage nuances, individuals can take steps towards achieving their desired dental health outcomes and improving their quality of life with this effective solution.

At Grove Dental Clinic in Falls Church, VA, we’re dedicated to helping our patients achieve optimal oral health year-round.

Schedule your expert consultation at Grove Dental Clinic in Falls Church, VA today! Call (703) 578-0000 to book your appointment now!